5 Key Benefits of Financial Consultation for Your Investments

- 1. Assessing Financial Goals

- 2. Developing Investment Strategies

- 3. Risk Management

- 4. Portfolio Diversification

- 5. Maximizing Tax Efficiency

- 6. Monitoring Investment Performance

- 7. Understanding Market Trends

- 8. Identifying Investment Opportunities

- 9. Staying Informed on Regulatory Changes

- 10. Planning for Retirement and Wealth Preservation

In today's complex financial landscape, investing has become

more challenging than ever before. With an overwhelming number of options

available and constant changes in the market, it's important to have a solid

investment strategy in place. This is where financial consultation can play a

crucial role.

Financial consultation involves working with a professional

advisor who can provide personalized guidance and expertise in managing your

investments. Whether you're a seasoned investor or just starting out, here are

five key benefits of seeking financial consultation for your investments:

1. Assessing Financial Goals

2. Developing Investment Strategies

3. Risk Management

Investing always comes with a certain level of risk. However,

managing and minimizing that risk is essential to protect your capital. A

financial consultant can assist you in identifying and assessing the risks

associated with different investment opportunities. They can provide you with

strategies to mitigate risk and help you make more calculated investment

decisions. By understanding and managing risk, you can potentially safeguard

your investments and improve your overall returns.

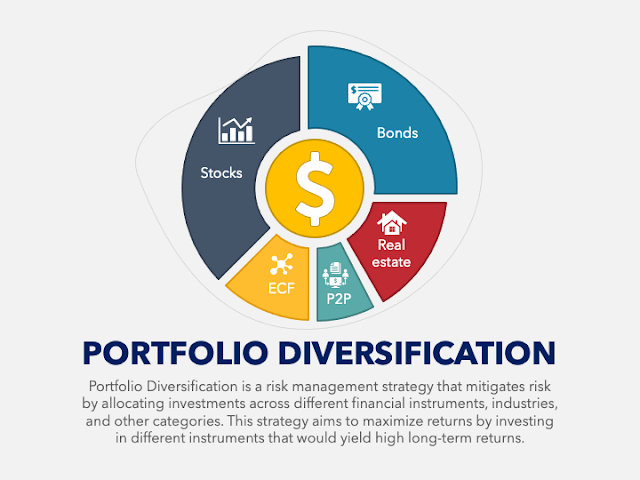

4. Portfolio Diversification

Diversification is a fundamental principle of investment

management. It involves spreading your investments across various asset classes

and sectors to reduce risk. A financial consultant can help you build a

diversified portfolio tailored to your risk tolerance and investment goals.

They can guide you on how to allocate your investments across different asset

classes, such as stocks, bonds, commodities, and alternatives, to create a

balanced portfolio. By diversifying your investments, you can potentially

reduce the impact of market volatility and improve the overall performance of

your portfolio.

5. Maximizing Tax Efficiency

When investing, it's important to consider the tax implications

of your investment decisions. A financial consultant can help you optimize your

tax efficiency through various strategies. They can provide guidance on

tax-efficient investment vehicles, such as tax-advantaged accounts, and help

you manage your investments in a way that minimizes your tax liability. By

maximizing tax efficiency, you can potentially increase your after-tax returns

and preserve more of your hard-earned money.

6. Monitoring Investment Performance

7. Understanding Market Trends

The financial markets are constantly evolving, and staying

informed about market trends is crucial for successful investing. A financial

consultant can help you stay up to date with market news, trends, and

developments. They can provide insights into the latest economic indicators,

industry-specific analysis, and global market trends. By having a clear

understanding of market dynamics, you can make more informed investment decisions

and potentially identify opportunities for growth.

8. Identifying Investment Opportunities

9. Staying Informed on Regulatory Changes

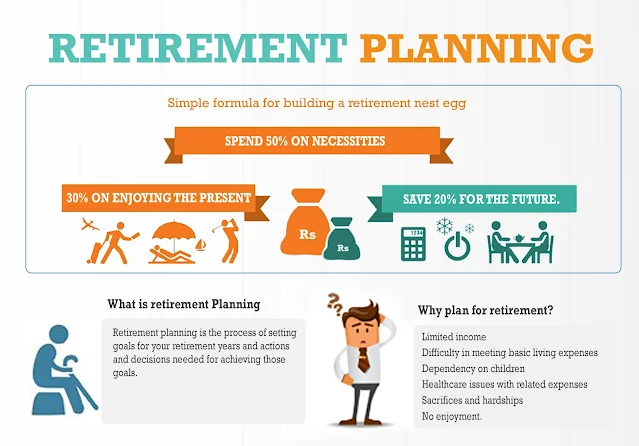

10.

Planning for Retirement and Wealth Preservation

In conclusion, seeking financial consultation for your

investments offers numerous benefits. From assessing your financial goals and

developing investment strategies to managing risk and maximizing tax

efficiency, a financial consultant can provide valuable guidance and expertise

throughout your investment journey. With their assistance, you can enhance your

investment decisions, optimize your portfolio performance, and work towards

achieving your financial objectives.